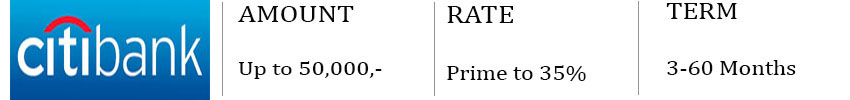

Personal Loans

How much are you looking for?

100% Free No Obligation

A personal loan is a type of unsecured loan given to individuals for personal needs, like funding a holiday, consolidating debt, or making major purchases. It's a lump sum that's repaid in regular installments, usually with interest, over a set period.

Here's a more detailed breakdown:

Key Features:

- Unsecured: Personal loans don't require collateral or security, making them accessible for various purposes.

- Lump Sum: You receive a fixed amount of money upfront.

- Installment Payments: You repay the loan in regular payments, usually monthly, over a specified term.

- Interest: Interest is typically added to the principal amount, increasing the total repayment amount.

- Versatile: Personal loans can be used for a wide range of personal expenses.

- Fixed vs. Variable Rates: Some lenders offer fixed interest rates that remain the same throughout the loan term, while others offer variable rates that fluctuate based on market conditions.

Apply With Us For Your Personal Loans Today

Frequently Asked Question

What do you mean by a personal Loan?

a personal loan is an unsecured loan that provides quick funds for various needs without requiring collateral. The personal loan definition covers its flexible usage, while details about personal loans highlight eligibility, interest rates, and repayment terms.

YES, personal loans may have fees associated with them, such as origination fees, prepayment penalties, Late paymen fees, and sometimes annual fees, it's essential to carefully review the terms and conditions before borrowing.